kansas sales tax exemption certificate

Most states with a sales tax have a farm machinery and equipment exemption for products used for agricultural production. IA Sales Tax Exempt Cert or Streamlined Retail Sales Tax Permit.

Florida Kansas and Missouri.

. KS PR-78 Form or Streamlined Retailers Sales Tax Registration Cert. If a non-Colorado-based retailer buying from a Colorado-based seller or the consumer has an exemption certificate issued by another state then the seller is not bound to collect the sales tax from. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity.

If your business is on the hook for sales tax in a growing number of states. The entire Form ST-28H including the direct purchase portion must be. For other Colorado sales tax exemption certificates go here.

The sales tax number and resale certificate are commonly thought of as the same thing but they are actually two separate documents. KS PR-78 Form or Streamlined. Printable Florida Example Sales Tax Exemption Certificate Form DR-13 for making sales tax free purchases in Florida.

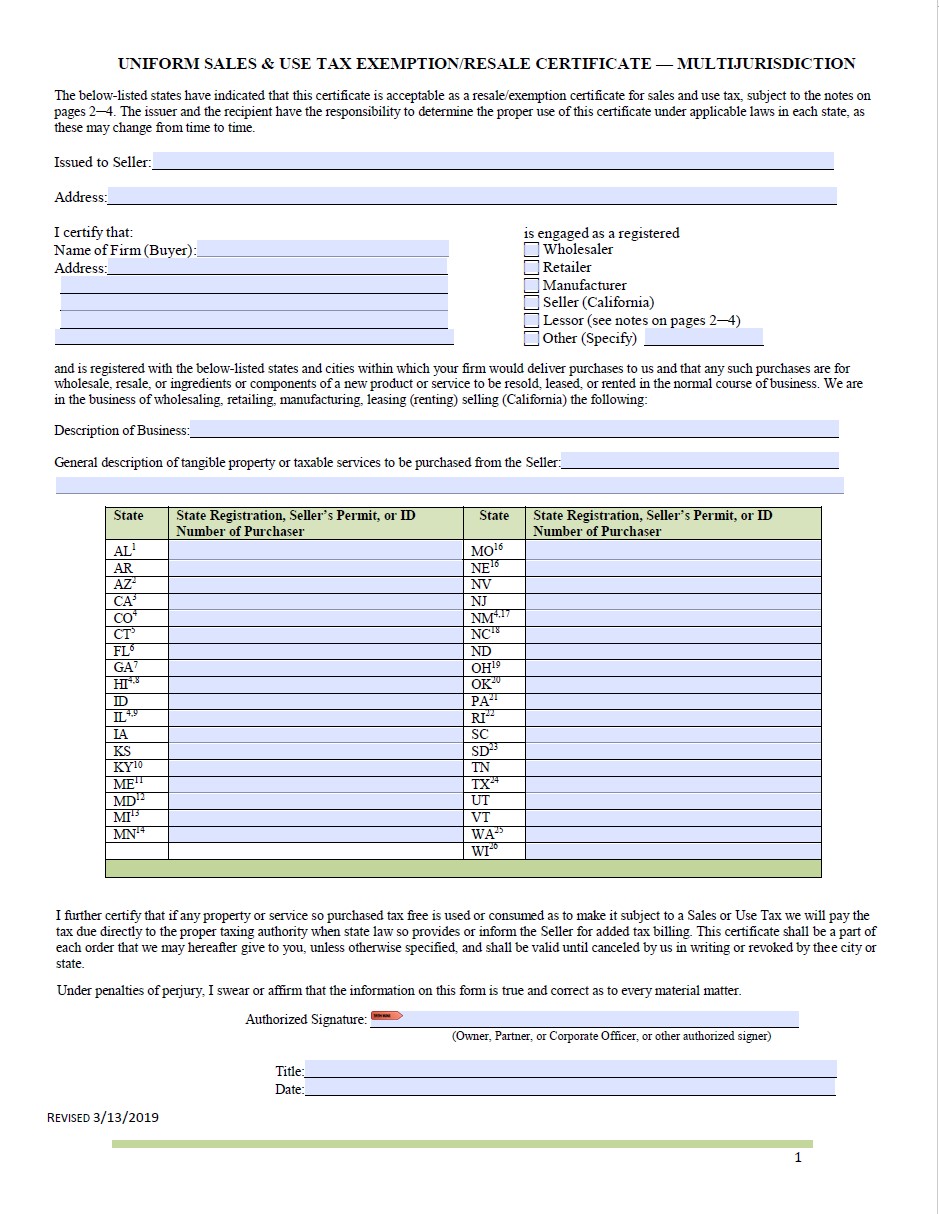

RESALE EXEMPTION CERTIFICATE 465718 The undersigned purchaser certifies that the tangible personal property or service purchased from. We would like to help make the certificate collection process as easy as possible for our customers. I hereby certify that I hold valid Kansas sales tax registration number and I am in the business of selling.

Or Designated or Generic Exemption Certificate ST-28 that authorizes exempt purchases of services. State issued exemption certificate. The sales tax number allows a business to sell and collect sales tax from taxable products and services in the state while the resale certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

First four digits of GSA CC or a Hard Copy of your PO. Please select your state below and follow the quick and easy steps for submitting your certificate to our team. Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA.

State Issued Exemption Certificate with. The certificate is also sometimes referred to as. AL State-Issued Certificate of Exemption.

By me in the form of tangible personal property or repair service. Colorado allows a retailer to accept an exemption certificate issued by another state. Of the 45 states plus the District of Columbia with a general sales tax only three have not adopted some form of economic nexus.

If your company is exempt from sales tax. An Indiana Sales Tax Exemption Certificate is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic.

AL State-Issued Certificate of Exemption.

Reg 256 Fillable Forms Facts Form

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Kansas Exemption Certificate Form Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller